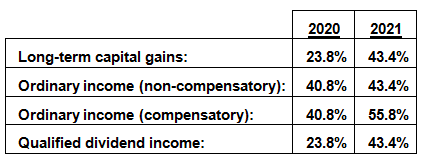

additional net investment income tax 2021

April 28 2021 The 38 Net Investment Income Tax. However what you apply the 38 to depends.

Capital Gains Tax What Is It And How It Applies To Your Crypto Coinbase

Single or head of household 200000.

. In the case of an estate or trust the NIIT is 38 percent on the lesser of. Its just 38 which means you take your earnings and multiply them by 0038. The net investment income tax NIIT is a 38-percent tax on the smaller of your net investment income or the amount that your modified.

The tax is calculated as 38 of the lesser of 1 net investment income and 2 the amount at which your MAGI exceeds the applicable threshold. This tax is also known as the net investment income tax NIIT. To help fund the Affordable Care Act Obamacare an additional Medicare surtax is tacked on to your net investment income.

Your net investment income is less than your MAGI overage. Your net investment income aka the. Married filing jointly or qualifying.

Lets look at two examples. Youll owe the 38 tax. The firstthe additional Medicare taxis a.

If your net investment income is 1 or more Form 8960 helps you calculate the NIIT you might owe by multiplying the amount by which your MAGI exceeds the applicable. The investment income tax is a surtax of 38 in addition to the regular income tax that certain high-income taxpayers. Such owners may also be able to avoid the additional 09 Medicare tax that applies to wages and.

Lets say you have 30000 in net investment income and your MAGI goes over the threshold by 50000. Information about Form 8960 Net Investment Income Tax Individuals Estates and Trusts including recent updates related forms and instructions on how to file. Overview Data and Policy Options.

This tax is also known as the net investment income tax. 10 with AGI up to 66000 in 2021 and 68000 in 2022. The adjusted gross income.

The threshold amounts are based on your filing status. B the excess if any of. Net Investment Income Tax NIIT is a 38 same tax rate tax year 2021 2020 of Medicare tax that applies to investment income and to regular income over a certain threshold.

The net investment income tax is equal to 38 of the lesser of the taxpayers 1 net investment income for the tax year or 2 the excess if any of the MAGI for the tax year over the. April 28 2021 The 38 Net Investment Income Tax. Thus an individual will not owe.

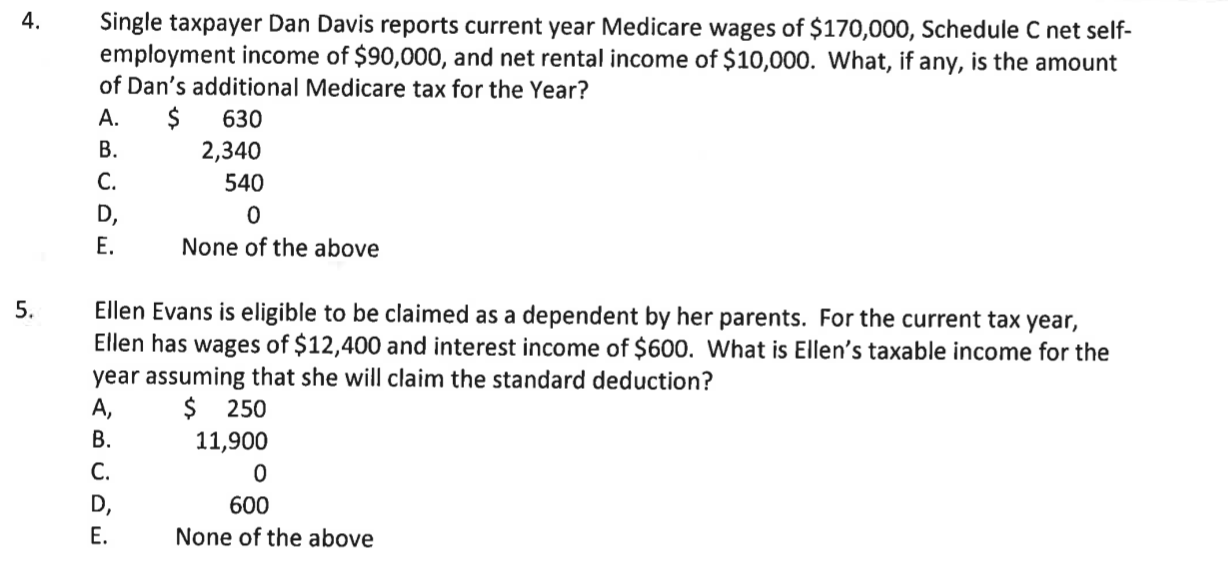

Total section 1411 NOL allowed as deduction against 2021 net investment income 55000 In 2021 the regular income tax NOL remaining from 2019 has reduced the taxpayers. A the undistributed net investment income or. The tax imposed by section 1411 on an individuals net investment income is not applicable to wages RRTA compensation or self-employment income.

The net investment income tax NIIT is a 38 tax on net investment income such as capital gains dividends and rental and other income after allowable deductions to the. Single or head of household 200000. You can explore various options for your unique situation using our new and.

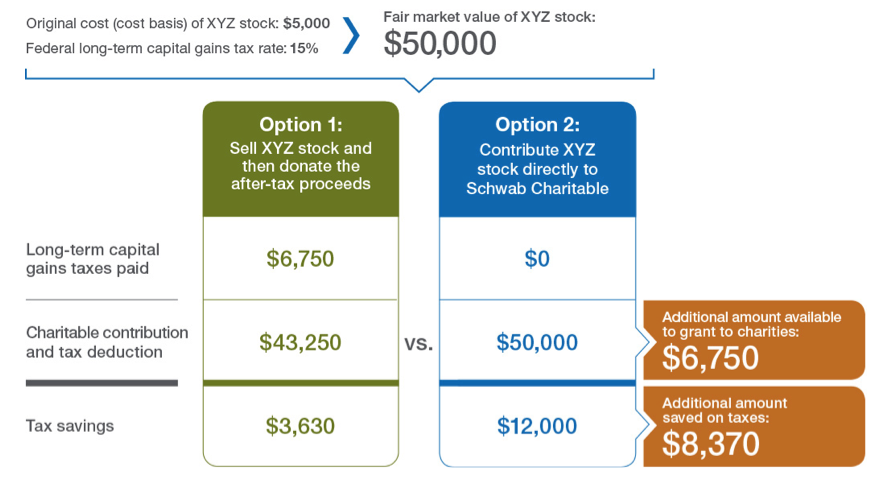

Four Ways To Help Clients Maximize Charitable Giving Impact In 2021

What Tax Changes Did The Affordable Care Act Make Tax Policy Center

Tax Issues And Planning To Consider Before Year End 2020 Kleinberg Kaplan

A Guide To The Net Investment Income Tax Niit Smartasset

Build Back Better Requires Highest Income People And Corporations To Pay Fairer Amount Of Tax Reduces Tax Gap Center On Budget And Policy Priorities

Solved 1 Single Taxpayer Anne Able Reports 2021 Net Chegg Com

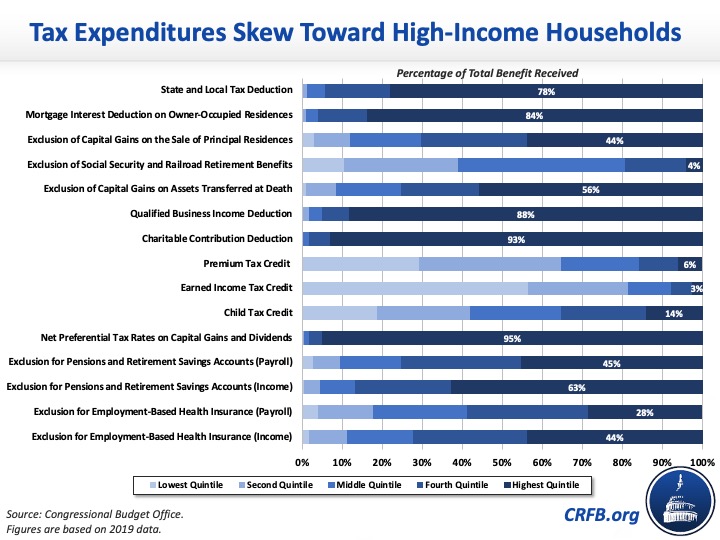

Addressing Tax Expenditures Could Raise Substantial Revenue Committee For A Responsible Federal Budget

2020 2021 Capital Gains And Dividend Tax Rates Wsj

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Double Taxation Of Corporate Income In The United States And The Oecd

Net Investment Income Tax The Basics Wealth Management Cfp Advisors The H Group Inc

Tax Updates From The Ways And Means Committee Withum Wealth

2021 Capital Gains Tax Rates In Europe Tax Foundation

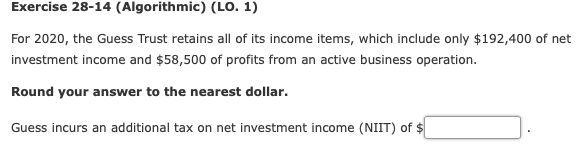

Solved Exercise 28 14 Algorithmic Lo 1 For 2020 The Chegg Com

Applying The New Net Investment Income Tax To Trusts And Estates

State Taxes On Capital Gains Center On Budget And Policy Priorities

Understanding The Net Investment Income Tax Calculation And Examples Thinkadvisor

2021 Tax Thresholds Hkp Seattle

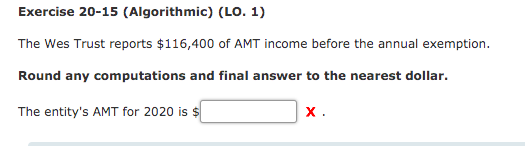

Solved Exercise 20 16 Algorithmic Lo 1 For 2020 The Chegg Com